CALYPS QOCKPIT

for Retail Banking

Leverage data to drive the bank

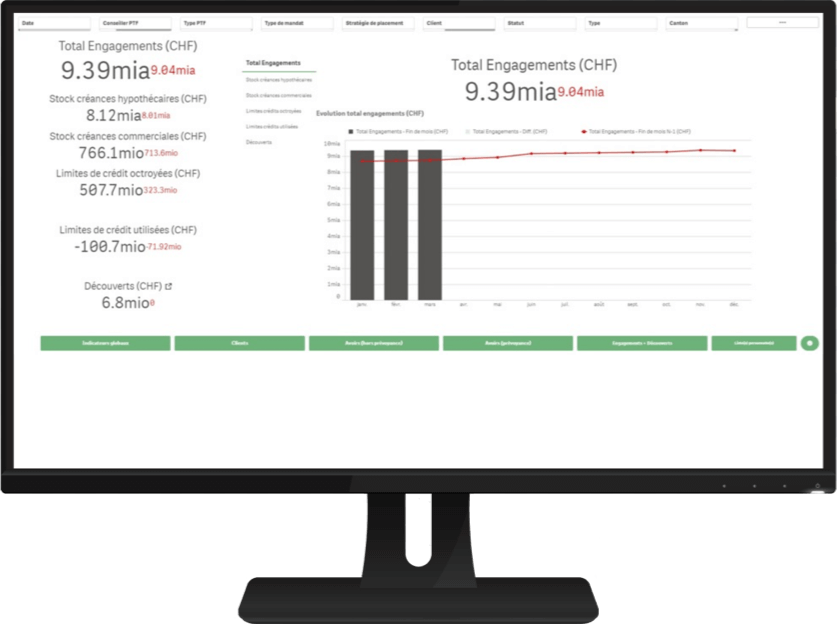

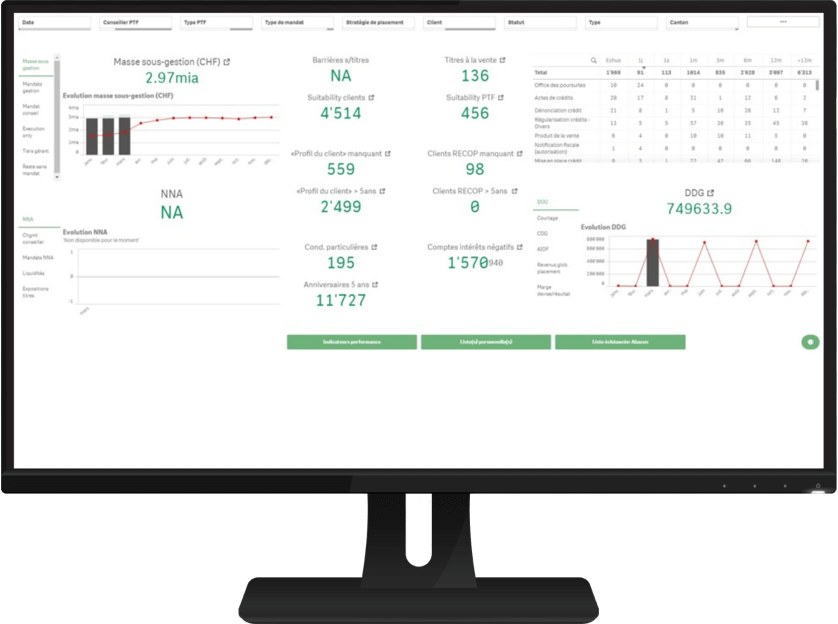

CALYPS Qockpit for Retail Banking not only responds to the questions that bank advisors ask themselves on a daily basis, but also provides them with information that they had not thought of, thus increasing their contextual understanding and giving them the leverage they need to achieve their objectives.

Take advantage of the data to better manage the bank and make it evolve by efficiently responding to the challenges posed by new uses.

Key elements

CALYPS Qockpit for Retail Banking simplifies the management of retail, universal and private banks

Rapid deployment & activation, with automated data collection from your data warehouse

Harmonized top-down view with unified indicators calculation & historical depth over N floating months

280+ filterable indicators, integrated in dynamic dashboards for individual clients, corporate clients, private clients, credits & risks assessment, executive committee, …

TARGETED GAINS

+ Steering

Analysis → decision → action → measure → analysis → decision

+ Rapidity

The right information at your fingertips, anywhere, anytime

+ Results

Well-informed and well-monitored advisors = better performance

HIGHLIGHTS

Based on Qlik Sense® + Vizlib®, including in memory data management

Artificial intelligence by CALYPS, with predictive indicators

100% Datawarehouse compliant

Secure access, rights & permissions synchronized with the bank's Active Directory

Fully responsive dashboards, rich visualizations, storytelling

User training with teaching material, complete documentation fully accessible online

AI for customer engagement

CALYPS develops algorithms that identify growth opportunities and recommend the next best action to each bank advisor, based on their respective client portfolio and their individual behavior. With the help of smart predictive indicators, the bank can drive its business by setting the right targets for its advisors, anticipating challenges (such as churn, lower lifetime value, etc.) and leveraging influencing factors that increase customer retention.